Health insurance is one of the most important financial safeguards you can have, but understanding how much it actually costs—especially for a single individual—can feel overwhelming. With varying plans, locations, and levels of coverage, the price tag for health insurance isn’t one-size-fits-all. Let’s break it down so you can understand the average monthly cost, what factors influence it, and how to potentially lower your premiums.

Average Monthly Cost of Health Insurance for One Person

As of 2025, the average monthly premium for a single person buying insurance on the U.S. marketplace is about $450 to $600, before subsidies. After applying income-based subsidies, many individuals may pay $50 to $100 per month—or even less.

These figures can change significantly depending on:

- Your age

- Location (healthcare costs vary widely between states)

- The level of coverage (Bronze, Silver, Gold, Platinum)

- Whether you qualify for government subsidies or employer coverage

Key Factors That Influence Monthly Premiums

1. Age

Older individuals generally pay more for health insurance. Insurers can charge up to three times more for older adults than for younger ones.

2. State and Region

Where you live has a big impact. For example, a single person in California might pay different premiums than someone in Texas or New York due to state regulations and healthcare market conditions.

3. Metal Tier Plan

Marketplace health plans come in four tiers:

- Bronze: Lowest premiums, highest out-of-pocket costs

- Silver: Moderate premiums and costs (qualifies for cost-sharing subsidies)

- Gold: Higher premiums, lower out-of-pocket costs

- Platinum: Highest premiums, but minimal costs when you get care

4. Income & Subsidies

Many individuals qualify for premium tax credits or Medicaid, which can dramatically reduce or even eliminate monthly premiums.

Real-World Examples

| State | Plan Type | Monthly Premium (Before Subsidies) | With Subsidies (Est.) |

|---|---|---|---|

| Texas | Silver | $520 | $85 |

| California | Bronze | $410 | $50 |

| Florida | Gold | $630 | $130 |

| New York | Silver | $490 | $70 |

These are sample figures based on a 30-year-old nonsmoker with no dependents.

How to Lower Your Health Insurance Costs

- Use the Marketplace at Healthcare.gov to check your eligibility for subsidies.

- Compare different plans annually during open enrollment.

- Look into catastrophic coverage plans if you’re under 30 or qualify for a hardship exemption.

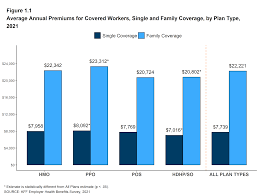

- Check if your employer offers group health insurance—it’s often more affordable.

- Consider a Health Savings Account (HSA) with high-deductible health plans to save on taxes.

Other Costs Besides Monthly Premiums

Your monthly premium isn’t the only cost to consider. Also think about:

- Deductibles

- Copayments

- Coinsurance

- Out-of-pocket maximums

A cheaper plan with a low premium might have very high out-of-pocket costs when you need care.

Conclusion

The monthly cost of health insurance for a single person can range widely depending on a variety of factors. On average, expect to pay between $450 and $600 per month without subsidies—but many people qualify for assistance that can bring their costs way down.

If you’re shopping for coverage, always take time to compare plans, assess your health needs, and explore subsidy options to find the best deal for your situation.